ABN AMRO - Design Thinking

At a glance

Duration

2 months.

Team

Evie Janssen, Fleur Venneker, Robert Broersma and Jesper Duinker.

My role

Design thinking process, User research, Interaction Design and Project management.

The challenge

For the course Design Thinking of the Master Human Centered Multimedia we had to take care of the following question for ABN AMRO:

‘’How is ABN AMRO going to create the most value to its customers from their personal information?’’

To come up with a meaningful solution within 2 months we focused on the target group students. Surveys and knowledge tests of students have found that financial knowledge is lacking and have identified how this lack of knowledge may interfere with financial decision making (Mandell 2008b). With personal debt loads compounded by student loans, students face very important challenges as they enter the work field (Avard et al., 2005).

Considering these facts, we believe that financial awareness is of great importance amongst students in order to fully control their personal finances with the future in mind.

The solution

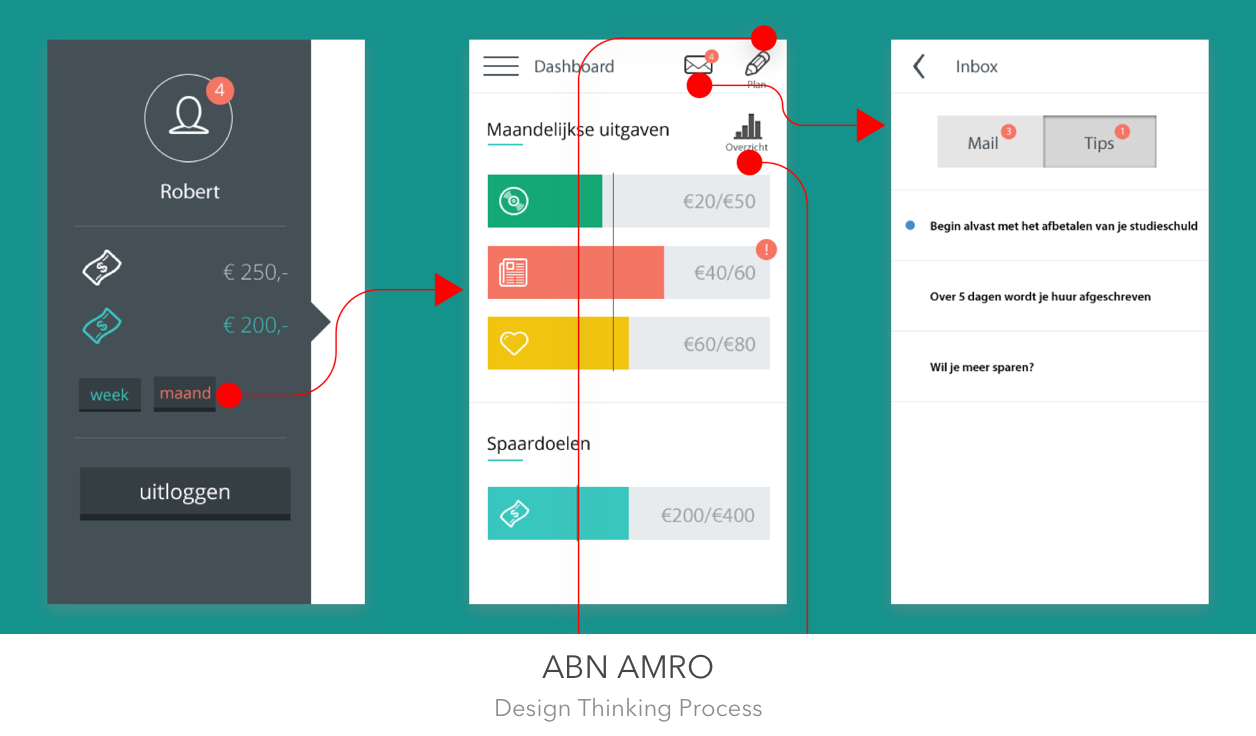

The solution should help creating more financial awareness amongst students in order to fully control their personal finances with the future in mind. It is important that the data is easy approachable and user friendly. Therefore, we created a mobile application in which user control and advice are key components. The application should be integrated into the existing ABN AMRO mobile banking application.

Design process

Research methods & results

1. Understanding

After the briefing of ABN AMRO there were a lot of ‘fragmenting forces’ which made it difficult to create a clear problem statement.

During the course we called this a ‘wicked problem’. Because there is no clear problem and it is not clear what is needed or needs to be solved. What was clear is that ABN AMRO wanted us to work with: quantified self, the existing data of ABN AMRO and the accompanying ethics and privacy.

After a client meeting we described the challenge as:

“How can ABN AMRO create the most value for their customers by using their existing data combined with the concept of quantified self?”

We created a mind map to represent our interpretation of the challenge.

2. Qualitative interviewing & User testing

With a better understanding of the challenge it was important to get a better understanding of the users of ABN AMRO.

An important choice was to contact ABN AMRO and ask them what research was already done. Based on this results we had a better idea of how the users are thinking about sharing their personal data with their bank. With this insight we could dive deeper in the problem space and focus on exploring the problem space. To get a better understanding of what the users want with regard to gaining insight in their finances, we talked with fellow students, friends and family.

Based on the research results from ABN AMRO and our own research results we made an empathy map. Making the empathy map provided us with a summary of all the insights we gained from observing the users.

3. Defining

Based on the scattered findings, the wicked problem, the social complexity and the insights that were gained from observing and doing research among the users of online banking of the ABN AMRO, there was concluded that there should be a more focused Point of View.

The empathy map provided us with meaningful insights in what the needs of the users of ABN AMRO are.

The most important choice that was made during this project challenge was acknowledging that for this time frame it is too difficult to solve the problem for all sub target groups within the users of ABN AMRO online banking, especially with relation to making a meaningful solution/prototype.

Based on the persona we could conclude that students want advice in the form of a personal approach; by assessing, goal setting, making a plan and monitoring the goals and plan.

The following Point of View was formulated based on the insights and needs of the user. This Point of View needs to help us in making a creative and meaningful solution.

“The user would like a mobile application that personally helps him assess his financial status and guides him in planning his financial future”.

4. Ideation

For the ideation process we made use of different techniques to create as much ideas as possible. To diverge our ideas we used techniques as: brainstorming, brain sketching and mind mapping.

During the whole process there were brainstorm sessions to help diverging our ideas. After that we had to think critical by converging our ideas. This was an iterative process.

5. Design concept / Prototype

After choosing the best three ideas from the ideation process we created different paper prototypes to be able to test the ideas quickly with the students.

This was also an iterative process.

Based on the research results from the paper prototypes we decided as a group which ‘prototype/idea’ had the most potential and could be visualised in more detail by developing the paper prototypes and feedback in a design in Photoshop.

6. Testing

After developing the design of the mobile application in Photoshop it could be tested again to get feedback from the target group before it could be developed in an interactive prototype. The whole test process was an iterative process in which the feedback was taken into account and was made into improvements in the mobile application design.

Reflection

Tools & Methods

Literature research

Interviews

User story (personas)

Ideation (brainstorming, brain sketching and mind mapping)

Prototyping (sketching, low and high fidelity)

Photoshop and HTML

Impact

Created a prototype for a specific target group of ABN AMRO within 7 weeks.

During the process we touched all critical Design Thinking stages to make sure the solution meets the users needs.

Used extensive user research, ideation, and an iterative design process to hone high-impact design opportunities. Design Thinking distinct itself from Agile by diving more and longer into the problem space and keeping different solutions open till the end of the process.

What I have learned

I learned and experienced that the chance of creating a more creative and meaningful solution for the user is bigger when working in a multidisciplinary team.

Co-creation with the user plays an important role in a project if you want to create a solution that is meaningful for the end users.

Without a clear interpretation of the challenge among all team members you are not able to create a creative and meaningful solution for the client.

With the empathy gaining part I was not familiar yet. The understanding and observation fase combined have helped me in developing a sense of empathy for the users of ABN AMRO.

I have learned that a good Point of View defines the right challenge based on my understanding of the target group and the problem space.

Using paper prototypes is easy and efficient to gain quick and valuable feedback from the user.

The iterative process of Design Thinking made it possible to improve the solution and add value in making a more creative and meaningful solution for the end user.

References

Mandell, L. (2008b). Press release announcing results of 2008 high and college survey. Washington: Jump$tart Coalition for Personal Financial Literacy.

Avard, S., Manton, E., English, D., & Walker, J. (2005). The financial knowledge of college freshmen. College Student Journal, 39(2), 321–339.